Markets

Zerodha Criticises Market Holiday Rule as Brokers Push Reform

Zerodha has criticised India’s stock market holiday framework, arguing that shutting exchanges for local elections no longer fits a digital trading reality. The comments have triggered a broader debate among brokers on whether legacy market closures are misaligned with how Indian markets operate today. Zerodha flags disconnect between market holidays and digital trading The criticism from Zerodha follows the closure…

Discover how India’s startup ecosystem is evolving in 2025 — the growth, the grit, and the game changers.

Stay Updated

We break down the signals that actually matter. Market shifts, policy triggers, sector shakeups, breakout founders, new capital flows, and the innovations that are quietly rewriting how business gets built in India. If it moves the narrative forward, we cover it – without the fluff.

More Stories

Indian equities open flat as global cues keep markets cautious

Indian equity markets opened largely flat today, reflecting the main trend of market mood shift. Despite the BSE Sensex trading near record levels, investors remain cautious ahead of major global cues and capital-flow uncertainty. Domestic benchmark near highs but lacking conviction The Sensex opened with modest gains, inching closer to…

Asia Markets Wobble on China Investment Slump; Ripple Effect Hits Commodity-Linked Economies

Asian markets are facing heightened volatility as China’s investment slump triggers ripple effects throughout the region, particularly affecting commodity-linked economies. With China, the world’s second-largest economy, grappling with slower growth and waning industrial investment, countries reliant on exports of raw materials and energy are now confronting increasing economic pressures. The…

Europe’s Industrial Revival Hinges On Financial Markets As Tech Slump Deepens

Industrial revival hopes in Europe now hinge heavily on the stability of financial markets as the region confronts a deepening tech slump that is weighing on equity valuations, investment pipelines, and business confidence. With technology stocks under pressure and funding conditions tightening, policymakers and industrial leaders face a challenging environment…

Tech and AI Valuations Under Scrutiny As Mega Rounds Trigger Market Rethink On Risk

Tech and AI valuations are coming under sharp scrutiny as a new wave of mega funding rounds raises fresh questions about risk appetite in cooling markets. Investors, regulators, and analysts are signaling caution as capital floods into a small group of AI-heavy startups while broader funding sentiment remains selective. The…

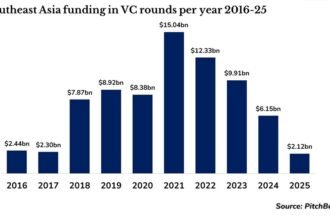

Southeast Asia Fintech Funding Falls To 2016 Lows As Global VC Turns Selective

Southeast Asia fintech funding has fallen to its lowest level since 2016 as global venture capital becomes increasingly selective. Startups across the region are confronting a difficult fundraising climate driven by tighter liquidity, higher investor scrutiny, and shifting priorities toward profitability over rapid expansion. The collapse in funding reflects a…

Global Markets Take a Hit: Tech Sell-Off and China Growth Jitters Ripple Through U.S., Europe, and Asia

Global markets are experiencing significant turbulence as a combination of a tech sell-off and growing concerns over China’s economic slowdown ripple through major economies, including the U.S., Europe, and Asia. Investors are bracing for a volatile period as fears about inflation, regulatory changes, and geopolitical instability mount, leading to a…

Most Popular

How Tier 2 Cities Are Becoming India’s New Business Hubs

India’s business landscape is shifting, and Tier 2 cities are emerging as significant players in…

Why Indian Exports Are Set to Rise Despite Global Slowdowns

India’s export sector is showing signs of resilience even as global economic growth slows down.…

The Future of MSMEs: Digital Adoption and Challenges

Micro, Small, and Medium Enterprises (MSMEs) are a backbone of India’s economy, contributing significantly to…

The Impact of AI on India’s Job Market and Skill Demand

Artificial intelligence is transforming India’s job market at an unprecedented pace. While automation and AI-driven…