Soft US data is strengthening expectation of a Federal Reserve rate cut, triggering a global rate pivot ahead and forcing investors worldwide to recalibrate portfolios across bonds, equities and commodities. The shift marks a potential turning point after months of tight monetary conditions.

Short summary: Weak US economic indicators have increased the likelihood of an upcoming Fed rate cut. Global investors are repositioning across asset classes as yields fall, risk appetite improves and expectations reset for the next quarter’s market trajectory.

Weak US Data Resets Market Expectations

Soft employment numbers, slower manufacturing output and easing inflation have collectively shifted sentiment toward an earlier Federal Reserve rate cut. Markets had been bracing for prolonged high rates due to sticky inflation, but recent data indicates cooling demand.

Lower inflation combined with softer labour market signals has pushed bond yields down across the US curve. The move immediately influenced global markets, with emerging market currencies strengthening, equity indices rising and commodity demand stabilising. Investors are now reassessing the timeline for monetary easing as the probability of a rate cut increases.

How Global Bonds Are Responding To The Shift

Yields decline as rate expectations soften

Bond markets were the first to react to weak US data. Treasury yields moved lower as traders priced in a higher probability of a policy pivot. The decline in yields has improved global financial conditions, reducing borrowing costs for governments and corporates.

European and Asian bond markets followed suit, with yields adjusting downward in anticipation of synchronized softening across central banks. Lower yields also provided relief to interest rate sensitive sectors, from real estate to capital-intensive industries.

Capital flows begin shifting toward duration assets

As yields fall, duration heavy bond portfolios become more attractive. Global funds are increasing exposure to long-dated government bonds and high-quality corporate bonds. This shift reflects expectations of a more accommodative rate cycle ahead.

The trend is especially relevant for emerging markets, where declining US yields typically encourage capital inflows and support local debt markets. Investors are watching currency stability and inflation trends to determine allocation levels.

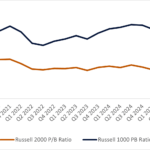

Equity Markets Rally On Improved Liquidity Outlook

Risk appetite returns across major indices

Equity markets across Asia, Europe and the US posted gains following the data release. Sectors sensitive to rate cycles such as technology, banking, infrastructure and discretionary consumption began showing renewed momentum.

With the prospect of lower rates, future cash flows look more attractive for growth stocks, lifting valuations. At the same time, value sectors like industrials and financials benefit from easier liquidity conditions and reduced borrowing costs.

Corporate earnings expectations get a sentiment boost

Lower interest rates reduce financing pressure for companies. This environment can improve profit margins and support investment plans. As a result, analysts are revising earnings expectations modestly upward for rate sensitive sectors.

However, investors remain cautious about the possibility that soft US data reflects deeper economic weakness rather than a controlled slowdown. The balance between disinflation and growth remains a critical variable.

Commodities Rebalance As Dollar Weakens

Oil, metals and agri commodities stabilise

The dollar weakened as rate cut bets firmed, giving commodities room to rebound. Oil prices steadied after recent volatility, and industrial metals saw mild gains supported by improved global demand expectations.

A softer dollar typically boosts commodity pricing as it reduces cost for non-US buyers. This trend supports exporters and improves trade conditions for commodity dependent economies.

Inflation management becomes more complex

A rebound in commodities could complicate the global disinflation process. While macro signals support rate cuts, policymakers will need to monitor whether commodity stabilisation translates into renewed input cost pressures.

Central banks in emerging markets, in particular, must balance currency stability with inflation control as global liquidity conditions shift.

What Investors Are Recalibrating Now

Portfolio managers are adjusting exposures across fixed income, equities, commodities and currencies to reflect new macro probabilities. Multi asset funds are increasing allocation to risk assets while trimming cash heavy positions.

Emerging markets could attract more flows if stability continues and the rate differential with the US expands. Currency markets, however, will remain volatile until clearer signals emerge from the Federal Reserve.

Investors are watching upcoming US data releases, central bank commentary and geopolitical shifts to determine whether this pivot becomes a sustained trend or a short lived sentiment swing.

Takeaways

Soft US data has strengthened expectations of a Federal Reserve rate cut.

Global bond yields are declining as investors shift toward duration assets.

Equity markets are rallying on improving liquidity and stronger risk appetite.

Commodities are stabilising as the dollar weakens, adding complexity to inflation management.

FAQ

Why are markets expecting a Fed rate cut now?

Because recent US data shows cooling inflation and softer economic activity, increasing chances of monetary easing.

How are global bonds reacting to the shift?

Yields are falling, and investors are allocating more to long-term government and high-grade corporate bonds.

What does this mean for equity markets?

Lower yields improve valuations for growth stocks and support earnings for rate sensitive sectors, boosting equity indices.

Will the commodity rebound raise inflation risks again?

Possibly. While the rebound is modest, any sustained rise in commodities could complicate the global disinflation process.