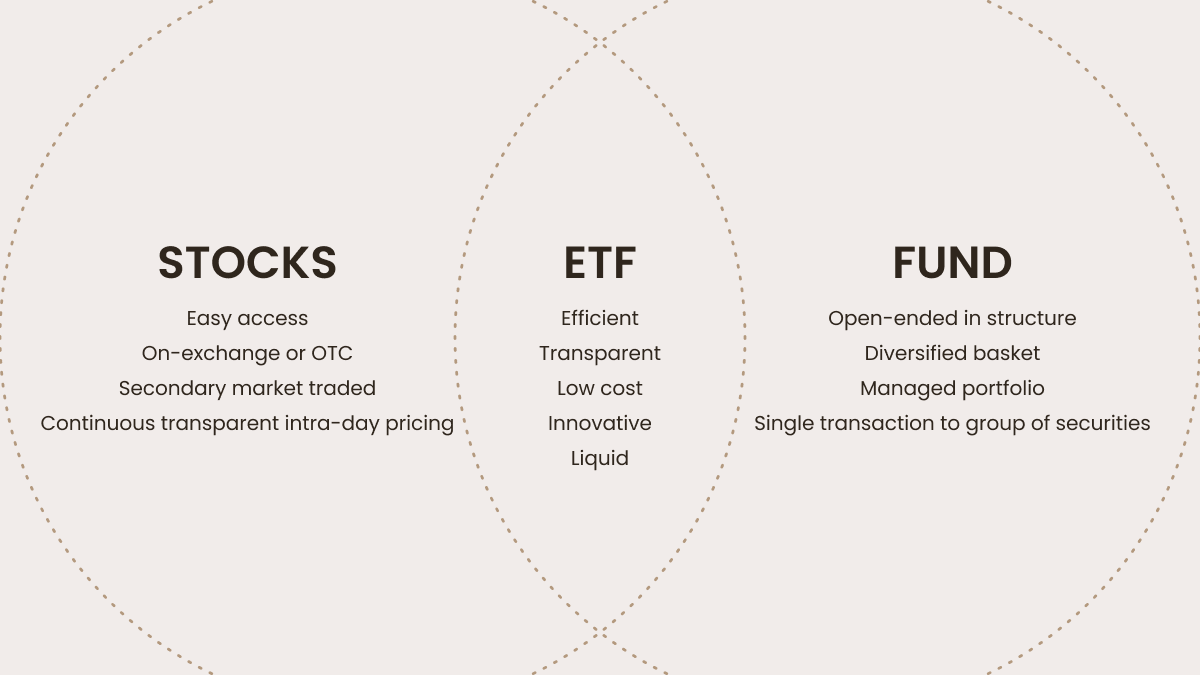

Exchange-Traded Funds, or ETFs, are gaining popularity among Indian investors as a flexible and cost-effective way to access diversified portfolios. Combining features of stocks and mutual funds, ETFs allow investors to buy a basket of securities in a single trade. This makes them appealing for retail investors in metros and Tier 2 cities who are looking to participate in markets efficiently while managing risk and expenses.

What ETFs Offer

ETFs track indices, sectors, commodities, or bonds, providing instant diversification. By holding multiple assets within one fund, they reduce the risk associated with individual stocks while offering the flexibility to trade like equities on the stock exchange.

Cost and Accessibility

One of the advantages of ETFs is their low expense ratios compared to actively managed mutual funds. They are easy to buy and sell through brokerage accounts, making them accessible to investors in smaller cities who may have limited capital but want exposure to broader markets.

Flexibility and Liquidity

ETFs offer intraday trading, allowing investors to react quickly to market movements. They can be used for long-term investment strategies or short-term trading, providing liquidity and convenience while maintaining exposure to a diversified set of securities.

Risk Considerations

While ETFs reduce stock-specific risk, they are still subject to market fluctuations. Investors should understand the underlying assets, track performance, and align ETF choices with their financial goals to avoid unexpected losses.

Conclusion

ETFs are a practical and versatile tool for investors looking to balance diversification, cost efficiency, and trading flexibility. By leveraging ETFs wisely, investors across India, including those in Tier 2 cities, can participate in financial markets confidently while managing risk and optimizing portfolio growth.